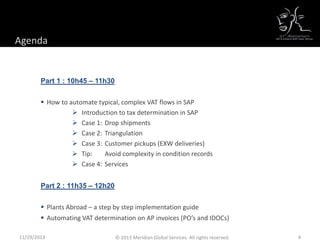

Configuring sap-for-european-vat-–-implementation-tips-and-tricks-from-the-experts-ryan-ostily-and-roger-lindelauf-meridian-global-services | PPT

Services rendered date determination with relation to tax condition record determination | SAP Blogs

Services rendered date determination with relation to tax condition record determination | SAP Blogs